Manage Separate Pots of Money in GnuCash

Updated 2021-06-07

Introduction

In this post, I will talk about how to manage separate pots of money in GnuCash. If you would like a bit more detail about GnuCash, please refer to my prior post on managing medical costs using GnuCash.

Why would you want to have separate pots of money? Having separate pots of money can prevent unpleasant financial surprises, can lessen the impact of large bills, and can help you achieve future financial goals. For example, on a monthly basis I used to set aside a set amount of money for automobile insurance, which I paid on a bi-annual basis. Other uses could be to setup: an emergency fund, a future automobile purchase fund, a vacation fund, etc.

Before I learned and began using GnuCash, I used Quicken. When I used Quicken, I would manage separate pots of money directly under my checking account with a combination of dates, descriptions, and negative dollar amounts. For example, my automobile insurance was due bi-annually, so I would have an entry dated close to the due date, a description like Auto Insurance, and then a negative dollar amount that I incremented monthly. The incremented dollar amount was a monthly amount determined by dividing the amount due on the due date by six.

When I began using GnuCash I used the same technique, but under GnuCash reconciling my checking account on a monthly basis became tedious because of all the entries for managing separate pots of money. After thinking things over for quite awhile, experimenting with other methods, and then brushing up on accounting principles, I developed a method that works much better without using my checking account.

Details

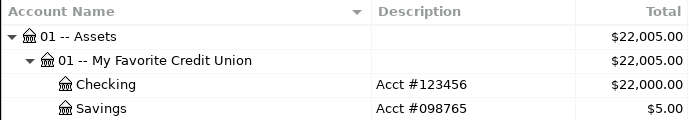

I create a number and account name for all of the major account categories in GnuCash so that they will sort the way I desire. The major account category Assets starts with the number 01 and then minor asset account categories are also created with a number and account name starting with the number 01. For example, I assign the number 01 for my credit union account and then the separate credit union accounts are listed as subaccounts.

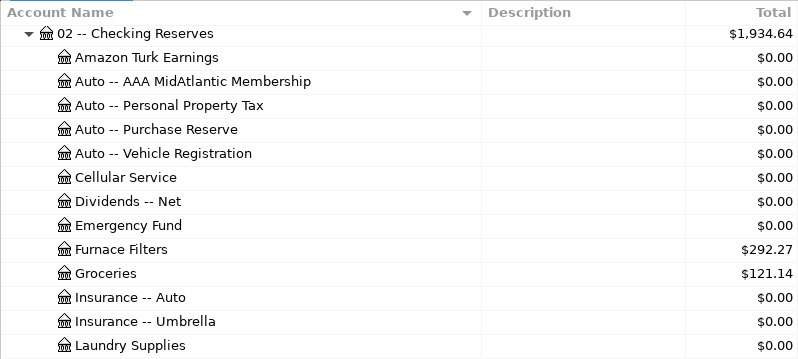

I use a minor asset account with the number 02 and an account name of Checking Reserves for managing separate pots of money. I use subaccounts under the Checking Reserves account with account names representing the pots of money I have set aside. Examples are: Automobile Insurance, Life Insurance, Umbrella Insurance, Automobile Purchase, Cellphone Service, Emergency Fund, etc.

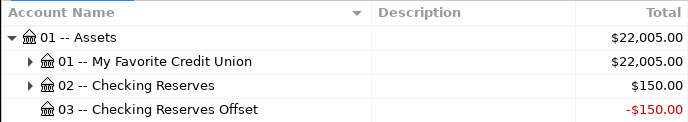

So that total assets aren’t overstated by the accounts used to manage separate pots of money, I created another minor asset account with the number 03 and an account name of Checking Reserves Offset. The Checking Reserves Offset account is a contra asset account to the Checking Reserves account. Therefore, the Checking Reserves Offset account balance should always be a negative amount and be the opposite of the Checking Reserves account balance. I do not use any subaccounts for the Checking Reserves Offset account.

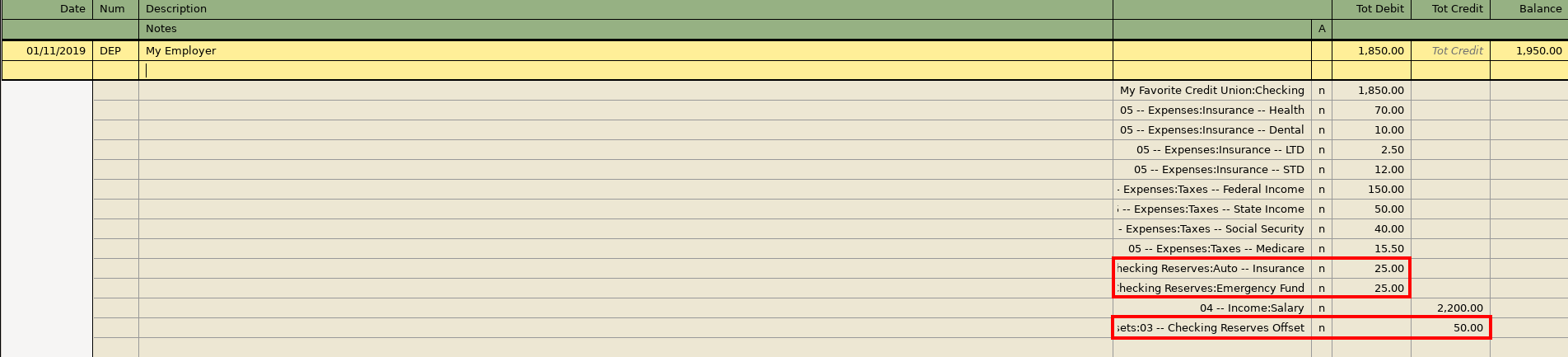

Allocation

Now let’s go over how to allocate money to the Checking Reserves subaccounts and the Checking Reserves Offset account. You get your paycheck and you want to allocate money from the paycheck for future bills, expenditures, or financial goals. In addition to recording the usual amounts from your paycheck, you also make entries to the applicable Checking Reserves subaccount(s) and the Checking Reserves Offset account. Specifically, you will debit or increase the desired Checking Reserves subaccount(s) and credit or increase the Checking Reserves Offset account. Remember, the Checking Reserves Offset account balance should always be the negative of the Checking Reserves account balance.

Expenditures

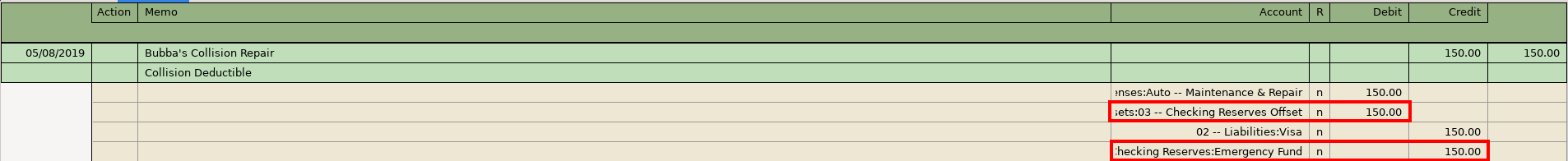

When you eventually pay a bill or make an expenditure affecting one or more Checking Reserves subaccounts, you will credit or decrease the affected Checking Reserves subaccount(s) and debit or decrease the Checking Reserves Offset account.

For example, say you were involved in an automobile accident and it was the other person’s fault. However, your auto insurance policy has a $150 deductible. You weren’t planning on such an expense, so you opt to dip into your emergency fund to cover the deductible. In addition to the normal entries made to record the expenditure in your credit card account, you will also credit or decrease the applicable Checking Reserves subaccount and debit or decrease the Checking Reserves Offset account. Once again remember, the Checking Reserves Offset account balance should always be the negative of the Checking Reserves account balance.

Conclusion

I’ve included a GnuCash sample file that you can use as a template or guide in creating your own setup. I’ve also provided a GPG signature for the GnuCash file that can be used to verify that the file has not been tampered with. The signature of the GnuCash sample file should be verified before decompressing it. You will also need the Shared Bits public key and verification software.

The only issue with using my method of managing separate pots of money is that you have to remember to make the appropriate entries to the Checking Reserves subaccount(s) and the Checking Reserves Offset account. However, using Checking Reserves subaccounts and a Checking Reserves Offset account has proven beneficial to me for managing separate pots of money. I hope you find my method useful for your personal financial management needs as well.

Note: Most of the data used in this tutorial, and all of the data in the attached GnuCash sample file, are fictitious.

Post header image courtesy of alfapp at Pixabay.

2019-007